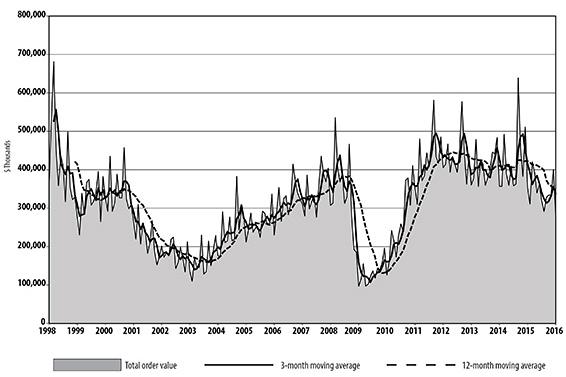

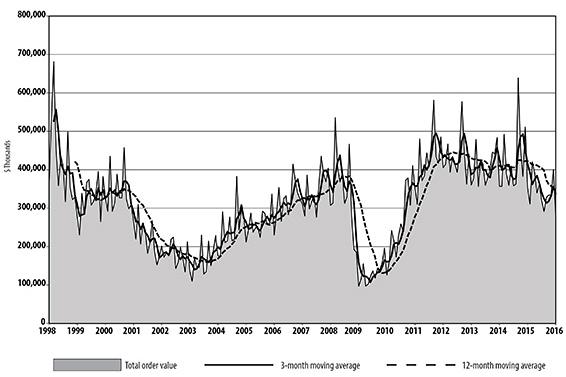

The January 2016 total for new machine tool orders represented the lowest monthly result in the past year, though AMT pointed to the high average value for individual machine tools as a positive development.

U.S. manufacturers’ new orders for machine tools totaled $278.79 million during January, the first month of the year for which AMT – the Association for Manufacturing Technology has forecast a slow recovery toward a 3% annual increase. The January result falls 30.4% below the December 2015 order volume, and 21.2% below January 2015 orders.

The data is included in the monthly U.S. Manufacturing Technology Orders report, which AMT bases on actual machine tool orders reported by participating companies that produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. The USMTO is offered as an indicator of capital investment (not manufacturing activity) and represents manufacturers’ confidence in current and developing economic conditions.

As such, the decline from December USMTO results reflects the high level of late-year buying by machine shops and other manufacturers seeking to invest annual gains (or to take advantage of machine tool builders and distributors discounts.) Even so, while it’s still listed as preliminary, the January 2016 order volume is the lowest monthly total in the past year.

In contrast, AMT noted the average value of individual machine tools ordered during January reached the highest level since January 2015, “suggesting manufacturers are buying more sophisticated manufacturing technology to ramp-up productivity rather than expand operations, which would show a broader increase in orders and lower unit values.”

Among the markets that performed well and prompting new machine tool orders during January were automobile, aerospace, and medical equipment manufacturing; the off-road construction vehicles, oil-and-gas production, and agriculture equipment markets continue to disappoint machine tool suppliers.

“The drop in orders was not unexpected,” according to AMT president Douglas K. Woods. “January numbers are typically lower than December as companies that have financial years synced with the calendar year place delayed orders based on where they are relative to budget goals.

“This cycle will be less dramatic in 2017,” Woods predicted. “The temporary tax incentives which have spurred year-end buying decisions for more than a decade are now permanent or extended for several years.”

AMT’s 2016 forecast calls for manufacturing technology orders to finish 2016 up 3% compared to 2015 (or roughly $4.31 billion), in particular with the boost provided by September’s IMTS 2016 event.

The January USMTO’s regional results showed the weak demand levels commensurate to the nationwide new-order record. In the Northeast, new orders for metal-cutting equipment fell 16.3% from December and 40. 1% from January 2015, settling at $89.34 million for the month.

In the Southeast region, new orders for metal-cutting equipment fell 22.2% from December, but rose 49.2% from January 2016. AMT called the Southeast regional results “particularly strong when compared to other regions of the country,” and credited presence of automotive, aerospace and medical equipment manufacturing in the region.

The North Central-East region had total $66.43 million worth of new orders during January, down 39.3% from December and down 27.2% from the January 2015 result.

The North Central-West region reported metal-cutting equipment orders totaling $44.58 million, 40.0% less than during December and 28.4% less than during January 2015.

The South Central region’s metal-cutting equipment new-orders total was just $13.31 million, 37.2% less than in December and 52.6% less than in January 2015.

The West region reported metal-cutting equipment new orders worth $50.23 million, 30.4% less than December, but just 2.8% than the year-earlier totals.

The January 2016 total for new machine tool orders represented the lowest monthly result in the past year, though AMT pointed to the high average value for individual machine tools as a positive development.

U.S. manufacturers’ new orders for machine tools totaled $278.79 million during January, the first month of the year for which AMT – the Association for Manufacturing Technology has forecast a slow recovery toward a 3% annual increase. The January result falls 30.4% below the December 2015 order volume, and 21.2% below January 2015 orders.

The data is included in the monthly U.S. Manufacturing Technology Orders report, which AMT bases on actual machine tool orders reported by participating companies that produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. The USMTO is offered as an indicator of capital investment (not manufacturing activity) and represents manufacturers’ confidence in current and developing economic conditions.

As such, the decline from December USMTO results reflects the high level of late-year buying by machine shops and other manufacturers seeking to invest annual gains (or to take advantage of machine tool builders and distributors discounts.) Even so, while it’s still listed as preliminary, the January 2016 order volume is the lowest monthly total in the past year.

In contrast, AMT noted the average value of individual machine tools ordered during January reached the highest level since January 2015, “suggesting manufacturers are buying more sophisticated manufacturing technology to ramp-up productivity rather than expand operations, which would show a broader increase in orders and lower unit values.”

Among the markets that performed well and prompting new machine tool orders during January were automobile, aerospace, and medical equipment manufacturing; the off-road construction vehicles, oil-and-gas production, and agriculture equipment markets continue to disappoint machine tool suppliers.

“The drop in orders was not unexpected,” according to AMT president Douglas K. Woods. “January numbers are typically lower than December as companies that have financial years synced with the calendar year place delayed orders based on where they are relative to budget goals.

“This cycle will be less dramatic in 2017,” Woods predicted. “The temporary tax incentives which have spurred year-end buying decisions for more than a decade are now permanent or extended for several years.”

AMT’s 2016 forecast calls for manufacturing technology orders to finish 2016 up 3% compared to 2015 (or roughly $4.31 billion), in particular with the boost provided by September’s IMTS 2016 event.

The January USMTO’s regional results showed the weak demand levels commensurate to the nationwide new-order record. In the Northeast, new orders for metal-cutting equipment fell 16.3% from December and 40. 1% from January 2015, settling at $89.34 million for the month.

In the Southeast region, new orders for metal-cutting equipment fell 22.2% from December, but rose 49.2% from January 2016. AMT called the Southeast regional results “particularly strong when compared to other regions of the country,” and credited presence of automotive, aerospace and medical equipment manufacturing in the region.

The North Central-East region had total $66.43 million worth of new orders during January, down 39.3% from December and down 27.2% from the January 2015 result.

The North Central-West region reported metal-cutting equipment orders totaling $44.58 million, 40.0% less than during December and 28.4% less than during January 2015.

The South Central region’s metal-cutting equipment new-orders total was just $13.31 million, 37.2% less than in December and 52.6% less than in January 2015.

The West region reported metal-cutting equipment new orders worth $50.23 million, 30.4% less than December, but just 2.8% than the year-earlier totals.

The January 2016 total for new machine tool orders represented the lowest monthly result in the past year, though AMT pointed to the high average value for individual machine tools as a positive development.

U.S. manufacturers’ new orders for machine tools totaled $278.79 million during January, the first month of the year for which AMT – the Association for Manufacturing Technology has forecast a slow recovery toward a 3% annual increase. The January result falls 30.4% below the December 2015 order volume, and 21.2% below January 2015 orders.

The data is included in the monthly U.S. Manufacturing Technology Orders report, which AMT bases on actual machine tool orders reported by participating companies that produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported machinery and equipment. The USMTO is offered as an indicator of capital investment (not manufacturing activity) and represents manufacturers’ confidence in current and developing economic conditions.

As such, the decline from December USMTO results reflects the high level of late-year buying by machine shops and other manufacturers seeking to invest annual gains (or to take advantage of machine tool builders and distributors discounts.) Even so, while it’s still listed as preliminary, the January 2016 order volume is the lowest monthly total in the past year.

In contrast, AMT noted the average value of individual machine tools ordered during January reached the highest level since January 2015, “suggesting manufacturers are buying more sophisticated manufacturing technology to ramp-up productivity rather than expand operations, which would show a broader increase in orders and lower unit values.”

Among the markets that performed well and prompting new machine tool orders during January were automobile, aerospace, and medical equipment manufacturing; the off-road construction vehicles, oil-and-gas production, and agriculture equipment markets continue to disappoint machine tool suppliers.

“The drop in orders was not unexpected,” according to AMT president Douglas K. Woods. “January numbers are typically lower than December as companies that have financial years synced with the calendar year place delayed orders based on where they are relative to budget goals.

“This cycle will be less dramatic in 2017,” Woods predicted. “The temporary tax incentives which have spurred year-end buying decisions for more than a decade are now permanent or extended for several years.”

AMT’s 2016 forecast calls for manufacturing technology orders to finish 2016 up 3% compared to 2015 (or roughly $4.31 billion), in particular with the boost provided by September’s IMTS 2016 event.

The January USMTO’s regional results showed the weak demand levels commensurate to the nationwide new-order record. In the Northeast, new orders for metal-cutting equipment fell 16.3% from December and 40. 1% from January 2015, settling at $89.34 million for the month.

In the Southeast region, new orders for metal-cutting equipment fell 22.2% from December, but rose 49.2% from January 2016. AMT called the Southeast regional results “particularly strong when compared to other regions of the country,” and credited presence of automotive, aerospace and medical equipment manufacturing in the region.

The North Central-East region had total $66.43 million worth of new orders during January, down 39.3% from December and down 27.2% from the January 2015 result.

The North Central-West region reported metal-cutting equipment orders totaling $44.58 million, 40.0% less than during December and 28.4% less than during January 2015.

The South Central region’s metal-cutting equipment new-orders total was just $13.31 million, 37.2% less than in December and 52.6% less than in January 2015.

The West region reported metal-cutting equipment new orders worth $50.23 million, 30.4% less than December, but just 2.8% than the year-earlier totals.